In the heartlands of Chhattisgarh, a quiet revolution has been brewing. Manorama Industries – a company most investors haven’t heard of – has delivered returns that would make even the most seasoned portfolio managers weep with envy.

Rs. 10,000 invested when the company went public in 2018 would be worth over Rs. 85,000 today!

But here’s the kicker: this isn’t a tech unicorn or fintech darling – it’s a company that literally turns forest waste into the secret ingredients of your favourite Ferrero Rocher chocolates!

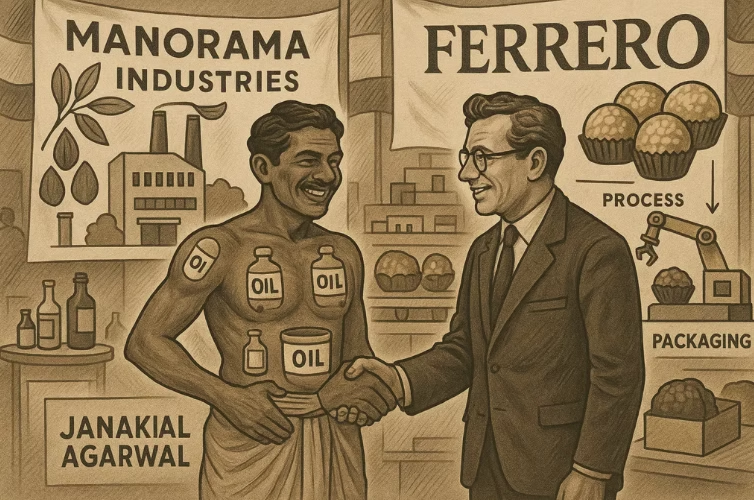

Picture this: a small-town Indian entrepreneur, set in the 1940s, travelling to Germany with samples strapped to himself because he believed so deeply in the quality of Indian forest produce that he was willing to bet his dignity on it.

This unconventional sales pitch by Janakilal Agarwal changed everything. At a German trade fair, this human product display caught the attention of Michael Ferrero himself – yes, the founder of the Ferrero empire that today generates over US$ 14 billion in annual revenues!

That chance encounter planted the seeds for what would become India’s speciality fats empire. It wasn’t until 2005 when Janakilal’s grandson Ashish Saraf, along with his family, incorporated Manorama Industries (named after Janakilal’s wife).

The mission? Converting India’s abundant forest waste into premium ingredients for the world’s most demanding customers. But what exactly does Manorama do?

Turning Forest Seeds into Premium Fats

Most companies that need Cocoa Butter Equivalents (used in chocolates and bakeries, replacing up to 30% of natural cocoa butter at 15–20% lower cost) and exotic butters/oils (cosmetics) simply purchase it from the open market.

Manorama Industries does something far more powerful: it picks raw Sal seeds, Shea nuts, Mango kernels and Kokum kernels directly from tribal regions, then processes them end-to-end; extraction, refining, fractionation and even enzymatic interesterification, all at its Birkoni plant in Chhattisgarh.

This full control and 20 years spent building trust with remote tribal gatherers create a moat that’s almost impossible for rivals to breach.

By owning every step and securing exclusive forest-sourced inputs, Manorama delivers consistent quality, lower costs and iron-clad ESG credentials, advantages no simple oil trader can match! So here is what truly fortifies its moat:

Pillar | Why It Matters | Evidence |

Unrivalled Tribal Sourcing Network | Direct raw-material access at unbeatable cost, full traceability and community empowerment. | 18,000+ centres; ~8 million tribal gatherers; 85,000 MT oilseeds procured in 2024 (+40% YoY); 15–20% below market rates |

Fully Integrated Specialty Fats Manufacturing | End-to-end in-house processing ensures quality, consistency and margin control. | Birkoni plant: 30,000 TPA refinery, 25,000 TPA fractionation, 15,000 TPA interesterification; CBEs fetch Rs. 52,000/MT vs. Rs. 40,000/MT olein; EBITDA margin up from 16% (FY24) to 25% (FY25) |

Global Reach & Blue-Chip Clientele | Premium partnerships and export focus drive scale and pricing power. | Exports = 73% of FY25 revenue; supplies Ferrero, Mondelez, L’Oréal, Unilever, The Body Shop; CBE sales Rs. 410 crore (+90% YoY), 20% of US$ 1.4 billion global market |

Together, these pillars create a self-reinforcing cycle: exclusive inputs feed world-class facilities, which win and retain global customers – delivering superior returns and sustainable growth few can replicate.

It is no surprise that financials also follow suit on the same theme of delivering superior returns:

Year | Revenue (Rs. crore) | EBITDA (Rs. crore) | PAT (Rs. crore) | EBITDA Margin | PAT Margin |

FY19 | 102 | 28 | 27 | 27% | 26% |

FY20 | 188 | 44 | 36 | 23% | 19% |

FY21 | 203 | 37 | 29 | 18% | 14% |

FY22 | 279 | 39 | 32 | 14% | 11% |

FY23 | 351 | 56 | 46 | 16% | 13% |

FY24 | 457 | 74 | 60 | 16% | 13% |

FY25 | 771 | 191 | 169 | 25% | 22% |

The transformation becomes even more impressive when you consider the company’s evolution.

Until FY19, Manorama was essentially a trading company that outsourced solvent extraction and refining. The strategic decision to establish an integrated plant at Birkoni, Chhattisgarh, in FY20 marked the inflexion point from commodity trader to premium speciality manufacturer.

Cut to FY25, the company is yet again riding on 3 tailwinds that might just secure its position among the greats!

3 Reasons Why Manorama Could Be the Next Big Thing

1. The Cocoa Crisis Creates a Once-in-a-Decade Opportunity

The global cocoa market is facing its worst crisis in over a century. Cocoa prices surged 178% in 2024, reaching historic highs of nearly US$ 12,931 per metric ton. West African production, which accounts for 70% of global cocoa supply, has been devastated by climate change, plant diseases, and the dreaded Cacao Swollen Shoot Virus.

Here’s where it gets interesting: Cocoa Butter Equivalents (CBEs), a US$ 2 billion global market, offer up to 30% cost savings while maintaining identical functional properties to natural cocoa butter.

Manorama is perfectly positioned to capture this windfall. The company’s enzymatic interesterification capabilities allow it to create a high-performance fat that yields up to 3.5x higher realisation, while reducing reliance on expensive, seasonal natural inputs.

💡The evidence is already showing: CBE revenues jumped 90% year-on-year to Rs. 410 crores in FY25, and with cocoa prices remaining elevated, this trend has substantial runway ahead.

2. The Plant-Based Revolution Meets Speciality Fats Goldmine

The second major opportunity lies in the global shift toward plant-based, clean-label products, with the global vegan cosmetics and speciality fats and oils markets both growing to US$ 30 billion each (growing by 7-8% every year till 2030).

This isn’t just a trend – it’s a structural shift. Manorama’s products are naturally vegan, sustainable, and ethically sourced. The company already supplies global giants like L’Oréal, Unilever, The Body Shop, and Nivea. As these brands double down on natural ingredients and ESG compliance, Manorama’s sourcing moat becomes even more valuable.

The R&D capabilities further strengthen this position. Led by Dr. Krishnadath Bhaggan (21+ years of experience in fats and oils), the team has filed 15+ patents across India and international markets.

💡The company earned the prestigious DSIR (Department of Scientific & Industrial Research) certification – a recognition shared by just a select group of Indian firms.

3. Operating Leverage Inflection Point: From Capacity Building to Cash Generation

The third compelling reason is operational leverage finally kicking in. Manorama just completed a major capacity expansion at its Birkoni plant, adding 25,000 MT of fractionation capacity. This new facility is the game-changer – it allows the company to move beyond basic processing to high-value, margin-accretive products.

The numbers tell the story: Asset turnover improved from 0.62x in FY24 to 0.78x in FY25, and EBITDA margins expanded from 16% to 25% as utilization ramped up.

As utilization continues to increase over the next two years, EBITDA margins could expand even further, potentially reaching 30%+ levels.

💡The company’s management has guided for Rs. 1,050+ crores revenue in FY26, which at current margin levels would translate to Rs. 315+ crores EBITDA!

Manorama Industries represents something rare in today’s markets – a genuine ESG story with compelling financial metrics. The company has built sustainable competitive advantages through irreplaceable sourcing networks, high-margin specialized products, and strong operational leverage from recent capacity expansions.

So the next time you bite into a Ferrero Rocher or use a Body Shop product, remember: there’s a good chance it contains ingredients sourced from the forests of Chhattisgarh and processed in Raipur by a company that’s quietly becoming one of India’s most successful speciality manufacturers.

From a grandfather’s audacious trade fair display to a Rs. 9,500 crore market cap – some stories are just too good to be fiction!

Make the Most of smallcases

smallcases are designed to simplify investing, but to truly maximise their potential, it’s essential to align them with your financial goals. Start by understanding the theme or strategy behind a smallcase—whether it’s focused on growth, dividends, or market trends.

Diversify your portfolio by combining smallcases across different sectors or strategies to balance risk and reward effectively. Regularly reviewing their performance and staying updated with market conditions can also help in making informed decisions.

Another way to make the most of smallcases is to use them as part of a long-term investment strategy. Many smallcases are crafted with a focus on sustainable growth over time, making them ideal for those looking to build wealth gradually. Leverage tools like SIPs (Systematic Investment Plans) offered by platforms to invest consistently and avoid the pitfalls of market timing.

smallcases combine convenience and strategy, making them a powerful tool for modern investors. By aligning with your objectives and investing wisely, you can unlock their potential for long-term growth. Explore, diversify, and invest smartly

Ready to take your investment journey to the next level? Rupeeting Smallcases have delivered impressive returns of 58% to 209% over the last three years. Subscribe today and join a community of savvy investors who prioritize long-term gains and solid returns —happy investing!