You’ve Got Assets

Now Get a Plan

We help high earners cut through complexity and invest with clarity and intention.

Everything Wealth

Fiduciary

First

It’s

Personal

Everything Wealth

$28.90M

120+

2016

Let’s Put A Strategy Behind Your Wealth

Understand

Before we recommend anything, we listen – to your goals, your fears, your financial reality.

We analyse your existing investments, map your risk appetite, and spot what’s working (and what’s not).

It’s not just discovery. It’s a diagnosis.

Rectify

Once we understand the gaps, we clean them up.

Whether it’s overlapping positions, high-cost holdings, or overexposure to market fads – we bring order to the chaos.

Clarity starts with cutting the clutter.

Build

Now, we get to work.

Using high-conviction ideas backed by research, we construct a portfolio and a plan that reflects your objectives – not a one-size-fits-all model. When it comes to our clients – ‘It’s Personal!’

It’s built for your goals, your pace, and your peace of mind.

Manage

Markets move daily, your focus shouldn’t.

That’s why we stay proactive – rebalancing, reviewing, and keeping you in the loop.

You’ll always know what’s happening, why it’s happening, and what’s next.

Client Assets Worth

Rs. 20,000 Crore +

Testimonials

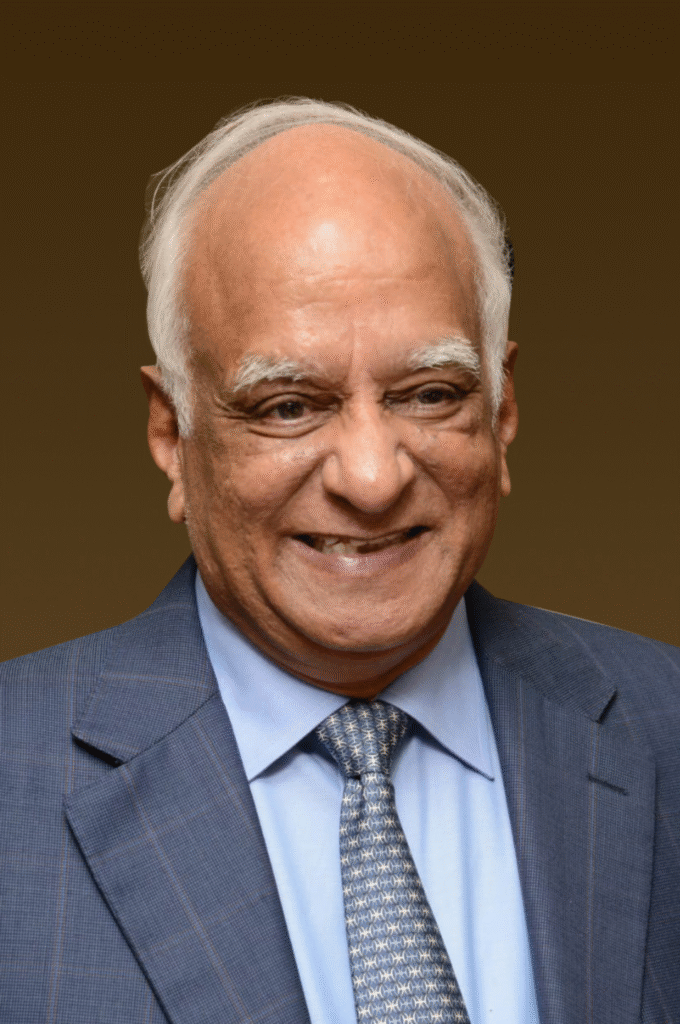

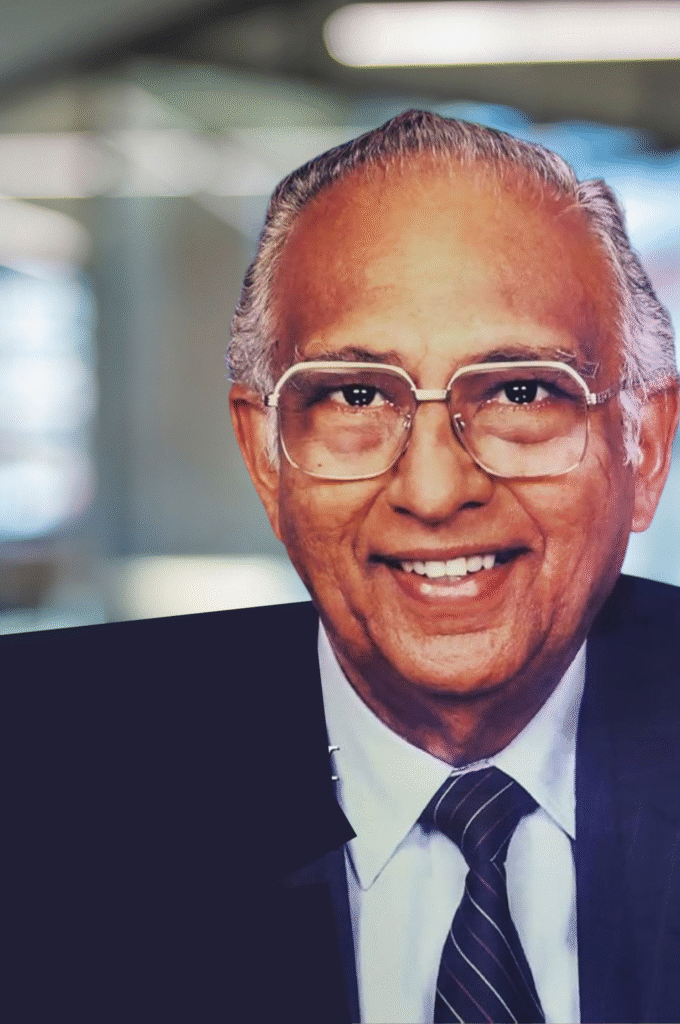

Former President of India

Chairman, Madras Cements Ltd.

Show More

Managing Director, India Pistons Limited

Chairman and Managing Director, MRF Limited

Testimonials

SEC Registered Investment Advisor

We help you achieve your vision and cultivate confidence and peace of mind across your financial journey.

Let’s Put a Strategy Behind Your Wealth Page

Drop By Or Simply Say Hi

Client Experiences That Speak for Themselves

“Finovate has been instrumental in our growth. Their team took the time to truly understand our needs and helped us eliminate inefficiencies.”

“Partnering with Finovate was a game-changer for us. They took the time to understand our challenges and helped us streamline our operations for success.”

“I hired Finovate for a small project & was very happy. He not only answered all my questions, but he didn’t treat me like a “small project”.

I was very satisfied & would recommend.”

Financial Planing FAQ’s

Common questions on financial planning and investing

What should a financial plan include?

A solid financial plan ought to cover a thorough look at your personal goals and aspirations, alongside an evaluation of your investment holdings. It should map out your expected income and expenses both before and after retirement, weigh the pros and cons of different retirement and investment account options, and outline strategies for retirement preparation, tax efficiency, charitable contributions, and safeguarding your assets through insurance.

On top of that, it should offer clear, actionable advice and steps to turn your goals into reality. To guide you toward the best decisions, a good plan will also lay out a variety of potential scenarios—plus some alternative ones—for you to consider.

Can you help me plan for retirement?

Retirement age varies widely from person to person. The big question is whether you’ve got enough saved up to support the lifestyle you’re aiming for, especially since retirement could stretch on for 30 years or longer. Your income during those years will likely come from a mix of sources: retirement accounts and savings, a pension if you have one, brokerage accounts, Social Security payments, annuity income if you’ve set that up, and any other investments you’ve built over time.

What is your investment philosophy?

We base our investment approach on evidence and decades of market history, not guesswork about the future. Research shows market timing doesn’t work. Instead, we focus on what you can control: risk, asset allocation, costs, and taxes. Emotional decisions often hurt long-term returns, so we aim to avoid those pitfalls.

Diversification lowers risk—not just by holding many assets, but by mixing company sizes, sectors, and balancing stocks and bonds. Risk can’t be erased, but it can be managed.

We keep expenses low with cost-effective mutual funds and ETFs, since high fees can erode even a well-diversified portfolio’s gains.

Taxes matter too. While unavoidable, they can be minimized with a smart, tax-aware strategy.

Will I have a dedicated advisor?

Absolutely, you’ll have your own personal advisor. At Execor, we’re all about building a strong, one-on-one connection between you and your advisor. We know everyone’s financial path is different, so we pair every client with a dedicated advisor who’s focused on getting to know you and helping you reach your unique financial goals.